Introduction

Introduction

Neo Bank is a parallel bank for SNB, targeting both Saudi and non-Saudi customers. NEO is a lifestyle banking and a financial ecosystem that enables ambitions at every step for all of life’s moments.

Neo Bank is a parallel bank for SNB, targeting both Saudi and non-Saudi customers. NEO is a lifestyle banking and a financial ecosystem that enables ambitions at every step for all of life’s moments.

App name

App name

Neo Bank

Neo Bank

My role

My role

Product Designer

UX Manager

Industry

Industry

Fintech

Fintech

Squads

Squads

4+

4+

Customers

Customers

12.2m

12.2m

Profit Margin

Profit Margin

25+

25+

My role

My role

I was responsible for the over-all design of the product, responsible to introduce the Backbase product to the different clients and work very closely with the Engineering team.

Take ownership of the entire design lifecycle of flows, journeys, and features: Discovery, Design, Development and testing;

I was responsible for the over-all design of the product.

I was also responsible to introduce the Backbase product to the different clients Streamline the ways of working, with & Develop Business Cases, work on Design thinking in Agile way.

Define and govern the execution of operating models and framework.

Communicating across complex stakeholder environments, PM’s Business Analysis, Technical Engineers, and C-suite stakeholders provide CX service design leadership tailored to government and enterprise clients

Take ownership of the entire design lifecycle of flows, journeys, and features: Discovery, Design, Development and testing;

I was responsible for the over-all design of the product, responsible to introduce the Backbase product to the different clients and work very closely with the Engineering team.

Take ownership of the entire design lifecycle of flows, journeys, and features: Discovery, Design, Development and testing;

Problem and challenge for Business

Problems

Understanding Local User Needs

Localization of content and Features

Adapting the OOTB Platform

Security Concerns

Balancing Innovation with Usability

User Education and Support

Solution finding

Conducted workshops and research to understand local user preferences and pain points.Customized user experience to align with local expectations and habits.

Collaborated with the development team to ensure high-speed accessibility and ease of use. Optimized performance, integrating local banking regulations and features.

Localized language, cultural references, and financial products.

Worked with legal and compliance teams to meet local regulatory requirements and integrate security measures. Iteratively designed and tested, using feedback to balance engaging features with a simple, intuitive user interface for young users.

Conducted workshops and research to understand local user preferences and pain points.Customized user experience to align with local expectations and habits.

Collaborated with the development team to ensure high-speed accessibility and ease of use. Optimized performance, integrating local banking regulations and features.

Localized language, cultural references, and financial products. Worked with legal and compliance teams to meet local regulatory requirements and integrate security measures. Iteratively designed and tested, using feedback to balance engaging features with a simple, intuitive user interface for young users.

Business opportunities

Business opportunities

Understanding Local User Needs

Localization of content and Features

Adapting the OOTB Platform

Security Concerns

Balancing Innovation with Usability

User Education and Support

Understanding Local User Needs

Localization of content and Features

Adapting the OOTB Platform

Security Concerns

Balancing Innovation with Usability

User Education and Support

Identify gaps and opportunities

Identify gaps and opportunities

We studied existing Saudi banks to identify gaps and opportunities, focusing on digital adoption, service speed, and user experience.

From our local research,

Youth prioritize mobile-first solutions, fast

Youth prioritize mobile-first solutions, fast

Business Goal

Business Goal

The business goal of Neo Bank is to provide a seamless social digital banking experience for both Saudi and non-Saudi customers, featuring multi-currency accounts and innovative branding.

The business goal of Neo Bank is to provide a seamless social digital banking experience for both Saudi and non-Saudi customers, featuring multi-currency accounts and innovative branding.

Avoid friction and ensure ease of use

Avoid friction and ensure ease of use

Avoid friction and ensure ease of use

Challanges

Challanges

The initial OOTB platform was not tailored to the specific needs and behaviors of our local

The Platform had limitations in flexibility and customization options.

Customization and Localization

Customization and Localization

Research Synthesis Empathy Map

Research Synthesis Empathy Map

Research Synthesis

Empathy Map

To synthesize the qualitative data gathered from user interview, I created an empathy map to identify patterns across users, uncover insights, and generate needs

To synthesize the qualitative data gathered from user interview, I created an empathy map to identify patterns across users, uncover insights, and generate needs

Local Pattern

Local Pattern

Empathy

Empathy

Insignts

Insignts

User interviews

User interviews

Key Approaches

Key Approaches

Data-Driven Decisions: Leveraged data analytics and user research to identify pain points and validate solutions based on user needs and business goals.

Collaborative Ideation: Conducted regular brainstorming sessions with cross-functional teams to generate innovative ideas from diverse perspectives.

Rapid Prototyping: Translated ideas into prototypes quickly, allowing for early testing and iteration to refine user experience before full-scale development.

User-Centric Design: Emphasized empathy and user-centered design, iterating based on feedback and usability testing to ensure intuitive and effective solutions.

Agile Workflow: Adopted an agile methodology, breaking the project into manageable sprints for quick adaptation and continuous improvement.

Data-Driven Decisions: Leveraged data analytics and user research to identify pain points and validate solutions based on user needs and business goals.

Collaborative Ideation: Conducted regular brainstorming sessions with cross-functional teams to generate innovative ideas from diverse perspectives.

Rapid Prototyping: Translated ideas into prototypes quickly, allowing for early testing and iteration to refine user experience before full-scale development.

User-Centric Design: Emphasized empathy and user-centered design, iterating based on feedback and usability testing to ensure intuitive and effective solutions.

Agile Workflow: Adopted an agile methodology, breaking the project into manageable sprints for quick adaptation and continuous improvement.

Role of the team?

Role of the team?

I facilitated open communication, ensuring alignment across the team. I mentored junior designers, maintained design standards, and promoted collaboration. Balancing autonomy with oversight, I ensured high-quality work while fostering a cohesive, professional environment.

I facilitated open communication, ensuring alignment across the team. I mentored junior designers, maintained design standards, and promoted collaboration. Balancing autonomy with oversight, I ensured high-quality work while fostering a cohesive, professional environment.

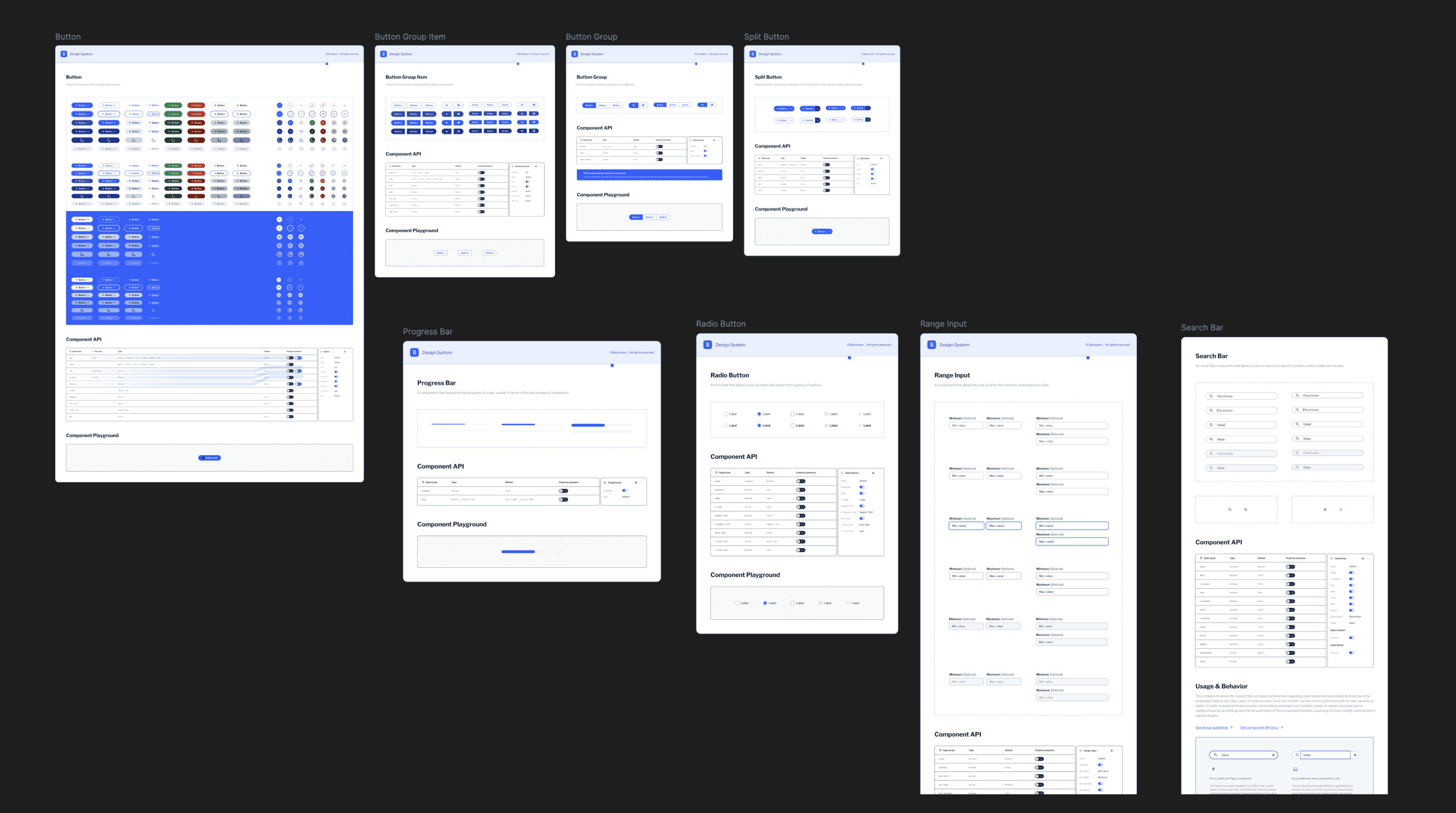

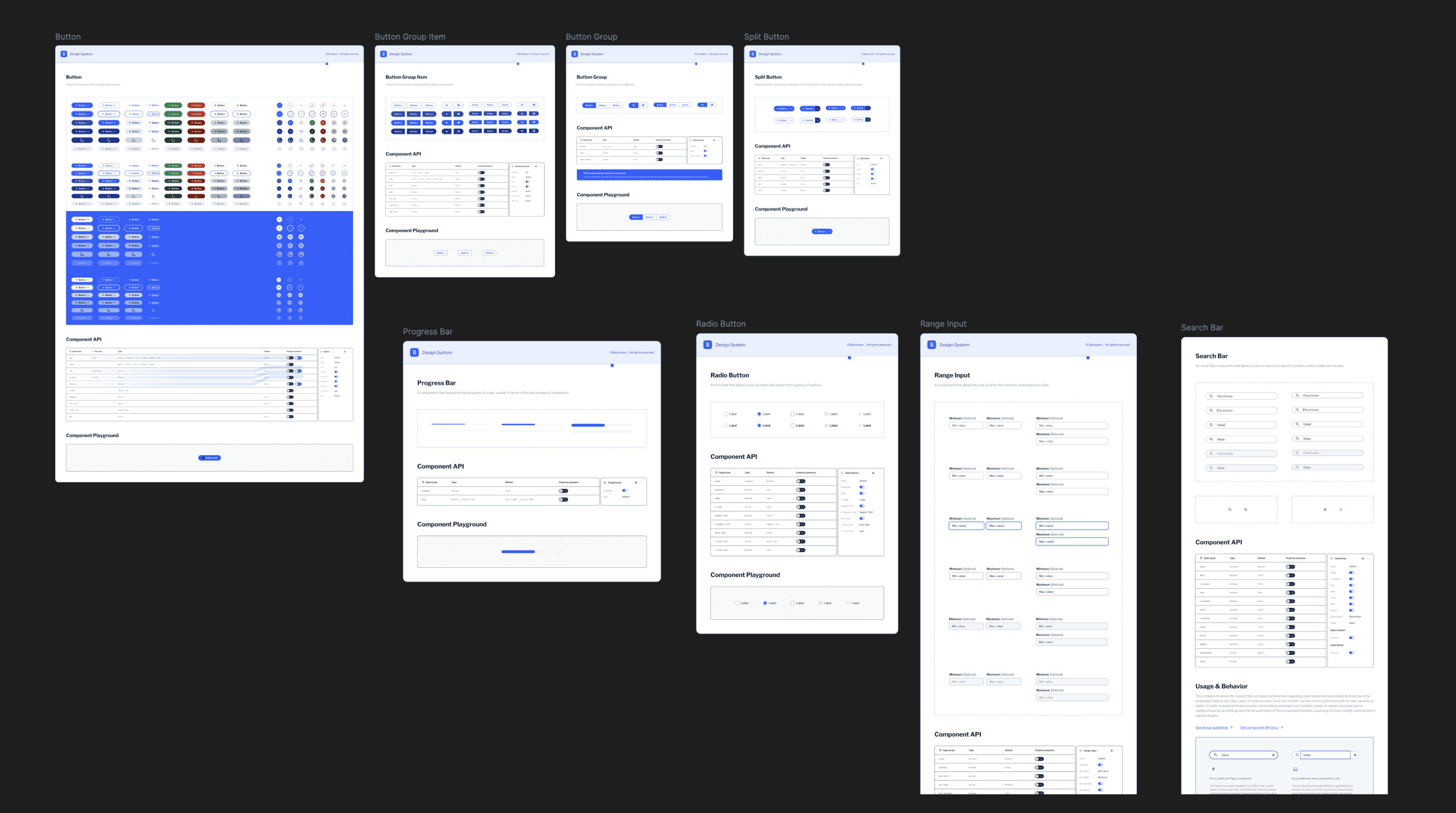

OOTB Platform

OOTB Platform

Backbase OTT Platform screens

Backbase OTT Platform screens

OOTB Out of Box Solution

OOTB Out of Box Solution

Discover the ease with which users can navigate our well-crafted interface.

Discover the ease with which users can navigate our well-crafted interface.

Product Roadmap

Product Roadmap

Roadmap for the banking app features after brainstorming with the Product Owner to align both business and user goals.

We prioritized key features like notifications, search, sign-in/sign-up, user profile, dashboard, account management, transactions, analytics, debit/credit cards, and user onboarding.

The roadmap, organized in an Excel sheet, helped us set clear milestones and ensure smooth execution..

Roadmap for the banking app features after brainstorming with the Product Owner to align both business and user goals.

We prioritized key features like notifications, search, sign-in/sign-up, user profile, dashboard, account management, transactions, analytics, debit/credit cards, and user onboarding.

The roadmap, organized in an Excel sheet, helped us set clear milestones and ensure smooth execution..

THE WAYS OF WORKING

AT SNB bank

THE WAYS OF WORKING

AT SNB bank

THE WAYS OF WORKING

AT SNB bank

Workshop & UX Audit

Workshop & UX Audit

Running work shop in Riaydh

Workshop & UX Audit

Running work shop in Riaydh

fundraising

recruiting

partnerships

investing

Sales